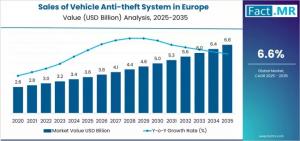

Europe Vehicle Anti-Theft System Market Set to Hit USD 6.8 Billion by 2035 with 6.6% CAGR

Advanced RFID, biometric, and steering lock technologies drive European automotive security innovation.

ROCKVILLE, MD, UNITED STATES, November 11, 2025 /EINPresswire.com/ -- The Europe vehicle anti-theft system market is set to expand from USD 3.6 billion in 2025 to approximately USD 6.8 billion by 2035, marking an 88.9% rise and a robust 6.6% CAGR. Growth is driven by rising vehicle theft rates, heightened regulatory scrutiny, and OEM integration of smart, AI-assisted security solutions across passenger and commercial fleets.As Europe strengthens its focus on theft deterrence, OEMs and aftermarket players are pushing toward next-generation systems—combining RFID encryption, biometric access, and predictive analytics to meet both compliance and user convenience goals.

Why It Matters Now

Vehicle theft across Europe is escalating, prompting governments and manufacturers to enforce stringent security standards. Anti-theft systems are no longer optional add-ons—they’re core to vehicle design, warranty value, and driver trust. OEMs are collaborating with security technology firms to integrate theft detection, cloud monitoring, and predictive locking systems directly into new vehicle programs.

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11346

Fast Facts

Market Size (2025): USD 3.6 billion

Forecast (2035): USD 6.8 billion

CAGR (2025–2035): 6.6%

Top Product Type: Steering locks (34.8%)

Leading Technology: RFID (42.3%)

Dominant Vehicle Type: Passenger cars (68.9%)

Key Growth Region: Poland (7.6% CAGR)

What’s Winning, and Why

Performance in this market comes down to response speed, integration ease, and user confidence. Systems that deliver seamless access control and verified security gains are rising fastest.

Power Adders: RFID and biometric systems enable fast, encrypted access and theft prevention.

Chassis/Brakes: Integration with ECU locks and brake immobilizers ensures tamper-proof protection.

Digital Tuning: Cloud-based and AI-powered monitoring boosts traceability and predictive security.

Where to Play

Aftermarket channels capture strong traction (42.2%) as consumers retrofit existing vehicles, while OEM installations lead volume share at 57.8%. OEM programs benefit from direct integration with vehicle electronics and compliance-driven standards.

Regional Standouts:

Poland (7.6% CAGR): Rapid automotive growth, strong focus on theft prevention.

Germany (7.1%): Engineering excellence drives AI-based and biometric adoption.

France (6.8%): Expanding security portfolios integrated with manufacturing programs.

Netherlands (6.7%): Innovation hub for predictive security analytics.

Italy (6.5%): Strength in production, expanding toward smart lock retrofits.

What Teams Should Do Next

R&D:

Advance hybrid locking systems combining RFID + biometric verification.

Develop modular ECU-linked immobilizers compatible with OEM platforms.

Optimize encryption algorithms for real-time authentication.

Marketing & Sales:

Highlight security credentials through demonstrable theft prevention data.

Bundle advanced locks with remote keyless and app-based access.

Build influencer and technician partnerships for aftermarket installs.

Regulatory & QA:

Standardize fitment and calibration documentation per EU norms.

Audit compliance for emissions and signal interference.

Establish clear warranty and security certification protocols.

Sourcing & Ops:

Dual-source RFID chips to prevent supply risk.

Pre-kit security modules for regional assembly centers.

Scale biometric sensor sourcing through EU-certified partners.

Three Quick Plays This Quarter

Launch a mid-tier RFID immobilizer targeting compact car OEMs.

Partner with national insurance providers on theft recovery analytics.

Pilot biometric ignition prototypes in fleet management programs.

The Take

Europe’s automotive security market is shifting from reactive theft protection to predictive, connected deterrence. OEMs and aftermarket suppliers who deliver clean installations, validated theft prevention, and transparent compliance will command trust—and repeat sales.

Purchase Full Report for Detailed Insights

For access to full forecasts, regional breakouts, company share analysis, and emerging trend assessments, you can purchase the complete report here: https://www.factmr.com/checkout/11346

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us – sales@factmr.com

To View Related Report:

Automotive Gear Shift System Market https://www.factmr.com/report/3275/automotive-gear-shift-system-market

Power Tool Batteries Market https://www.factmr.com/report/3616/battery-electrical-tools-market

Automotive Brake Rotor Market https://www.factmr.com/report/3873/automotive-brake-rotors-market

Golf Cart Market https://www.factmr.com/report/4537/golf-cart-market

About Fact.MR

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.

S. N. Jha

Fact.MR

+ +1 628-251-1583

sales@factmr.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.