European Union Colloidal Silver Market to Surpass USD 3.2 Billion by 2035 as Demand for Antimicrobial Innovation Rises

Demand for colloidal silver in the EU is expected to rise steadily, driven by growing consumer awareness and expanding applications across industries.

NEWARK, DE, UNITED STATES, November 7, 2025 /EINPresswire.com/ -- The European Union colloidal silver market is entering a rapid growth phase fueled by escalating antimicrobial resistance challenges, innovation in nanotechnology, and expanding adoption within healthcare applications across the region.

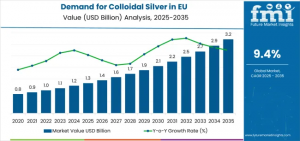

According to Future Market Insights, the demand for colloidal silver in the European Union is projected to reach USD 3.2 billion by 2035, up from USD 1.3 billion in 2025, registering a strong 9.4% CAGR throughout the forecast period. The market is expected to nearly 2.5X in value, representing an absolute increase of USD 1.9 billion.

First Half of Growth (2025–2030): Healthcare Adoption Accelerates

Demand is forecast to climb from USD 1.3 billion to USD 2.1 billion, driving USD 0.7 billion in new revenue and contributing 39% of the total 10-year expansion. Early-stage growth is supported by:

• Increased use of antimicrobial agents in hospitals and wound care centers

• Rising preference for therapeutic silver applications in supplements and cosmetics

• Portfolio expansion by manufacturers toward pharmaceutical-grade and certified medical-grade product formats

Second Half of Growth (2030–2035): Nanotechnology Drives Scale

From 2030 to 2035, revenue is expected to increase from USD 2.1 billion to USD 3.2 billion, adding USD 1.2 billion and contributing 61% of decade growth. This phase benefits from nanotechnology-enabled products that deliver precision-controlled particle size and superior performance in medical device coatings, advanced wound care, and pharmaceutical manufacturing.

Why Demand Is Growing

The surge in demand aligns with Europe’s intensifying focus on infection control, sterility assurance, and regulatory compliance within healthcare environments.

Key growth catalysts:

1. Healthcare adoption & infection control

Colloidal silver is increasingly used for wound care, surface sterilization, topical treatment, and medical device coating applications.

2. Regulatory alignment & certification requirements

European regulations now emphasize standardization of silver concentration, validated efficacy, and particle size specifications.

3. Scientific evidence and safety validation

Investment into clinical efficacy studies and documented purity is building confidence across hospitals and pharmaceutical manufacturers.

Segment Insights

✅ By Product Type (Form): Powder Dominates

The powder format holds 72.4% market share in 2025, expected to maintain 70% share by 2035.

Key advantages of powder:

• Better stability and shelf-life

• Precise dosage control

• Versatility for industrial and pharmaceutical formulations

✅ By Application: Healthcare Leads

Healthcare represents 35% share in 2025, rising to 38% by 2035, driven by its use in wound healing, infection control, and medical device sterilization.

✅ By Distribution Channel: Direct/B2B Procurement Growing

Direct/B2B channels account for 62% in 2025 and rise to 65% by 2035, highlighting the importance of technical documentation, certification support, and bulk procurement in healthcare and manufacturing.

✅ By Nature (Certification): Medical/ISO Certified Segment Expands

Certified/ISO-compliant formats contribute 55% share in 2025, rising to 60% by 2035, as hospitals increasingly prefer validated antimicrobial products backed by safety and compliance records.

Regional Leaders (CAGR 2025–2035)

Country CAGR

Spain 9.8%

Netherlands 9.7%

France 9.6%

Italy 9.5%

Germany 8.8%

Germany remains the largest market, holding 27.9% share in 2025 due to its established pharmaceutical ecosystem.

Competitive Landscape

The EU market is shaped by pharmaceutical ingredient suppliers, nanotechnology companies, and specialized antimicrobial material producers.

Major players include:

• Merck KGaA (Sigma-Aldrich) — ~10% share

• Laboratories Argenol (Spain) — ~7% share

• Thermo Fisher Scientific (Alfa Aesar) — ~6% share

• American Elements — ~5% share

Most competitors actively pursue:

• Nanotechnology manufacturing advancements

• Medical-grade certification

• Custom synthesis and formulation partnerships

Stay Ahead With Data-Backed Decisions. Gain Preview Access to Methodology, Sample Charts, and Key Findings by Requesting Your Sample Report. https://www.futuremarketinsights.com/reports/sample/rep-gb-27145

To Access The Full Market Analysis, Strategic Recommendations, And Analyst Support, Purchase The Complete Report Here. https://www.futuremarketinsights.com/checkout/27145

Why FMI: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.