5th Annual Index Crowns 2025’s Top 25 Pharma Leaders in Digital Health Innovation

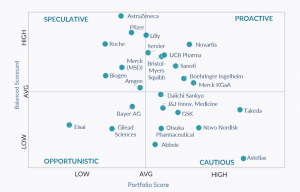

Quadrant chart from the Pharma Digital Health Innovation Index 2025, mapping 25 global pharma companies by Balanced Scorecard and Venture Portfolio scores into Speculative, Proactive, Opportunistic and Cautious segments.

5th annual Pharma Innovation Index reveals the 2025 ranking of top 25 pharma leaders reshaping global healthcare through digital health.

BOSTON, MA, UNITED STATES, December 9, 2025 /EINPresswire.com/ -- Galen Growth today released the 5th annual Pharma Digital Health Innovation Index 2025, unveiling the 25 pharmaceutical companies that are most successfully turning digital health from isolated pilots into measurable scientific, operational and patient impact.

The 2025 edition, powered by Galen Growth’s HealthTech Alpha intelligence platform, analyses thousands of data points on partnerships between pharma and digital health ventures to answer a simple but pressing question: who is really shaping the digital future of pharma – and how?

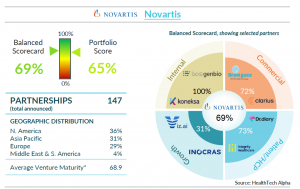

Built on more than 34,000 global digital health partnerships tracked over the past five years, the Index assesses the 25 most active global pharma companies using two complementary lenses: a Balanced Scorecard of digital health strategy and execution, and a Venture Portfolio Strength score that evaluates the quality, maturity and evidence base of their startup partners.

A tightening race for digital leadership

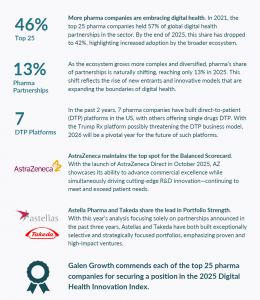

The analysis confirms that momentum is spreading beyond a small group of early movers. In 2021, the top 25 pharma companies accounted for 57% of all digital health partnerships involving pharma; by the end of 2025, their share had fallen to 42%, as hundreds of additional companies built their own collaborations. Pharma’s share of all digital health collaborations now stands at just 13%, reflecting a far more crowded and diversified ecosystem.

At the same time, the most active players still exert outsized influence. The top 25 pharmas collectively account for 46% of all digital health partnerships with pharma since 2012, while more than 875 other companies account for the remaining 54%.

Who is leading in 2025?

On the Balanced Scorecard, which evaluates how deeply digital health is embedded across commercial models, patient and HCP impact, internal R&D and operations, and long-term capability building, AstraZeneca maintains the top position for the second year in a row. Over the past three years, AstraZeneca has announced 40 digital health partnerships and, with the launch of AstraZeneca Direct in October 2025, has made a bold move into direct-to-patient services in the US.

Pfizer and Eli Lilly take second and third place, respectively, followed by Roche and Novartis, which jump into the top five from 17th place in last year’s ranking. Servier, UCB Pharma, Bristol Myers Squibb, Sanofi, and MSD (Merck & Co) complete the top ten.

On Venture Portfolio Strength – a ranking that looks only at partnerships announced in the past three years and scores ventures on management quality, financial robustness, clinical evidence and digital maturity – the leaderboard shifts. Astellas Pharma and Takeda share the number one position, followed by Novo Nordisk, Merck KGaA and Novartis. Boehringer Ingelheim, GSK, Sanofi, UCB Pharma and J&J Innovative Medicine round out the top ten.

The intersection of these two dimensions is visualised in a 2x2 matrix that segments companies into Cautious, Opportunistic, Speculative and Proactive quadrants. The most coveted position – the Proactive quadrant – is occupied by companies that combine strong strategic orchestration with high-quality venture portfolios, including Novartis, Eli Lilly, Servier, UCB Pharma, Bristol Myers Squibb, Sanofi, Boehringer Ingelheim and Merck KGaA.

Clinical evidence over hype

The 2025 Index underlines a decisive shift toward evidence-based collaboration. Around 73% of pharma’s digital health partnerships now involve ventures with demonstrated clinical strength, compared with 58% for health systems, 47% for big tech and 43% for payors.

This emphasis on regulatory-grade evidence, peer-reviewed data, and real-world outcomes is particularly evident in clusters such as Medical Diagnostics, Remote Devices, Clinical Trials, Patient Solutions, and Research Solutions, where clinically robust ventures are most concentrated.

Direct-to-patient and trial innovation in focus

The Index also tracks the strategic bets reshaping pharma’s business models. Over the past two years, seven pharma companies have launched direct-to-patient (DTP) platforms in the US, with others piloting single-drug DTP offerings. The report notes that 2026 will be a pivotal year for this model as competitive and policy dynamics test which platforms can demonstrate durable value for patients, payors and providers.

On the R&D side, the analysis highlights a rapid shift toward digital tools that can shorten timelines and de-risk trials, from decentralised clinical trial technologies to AI-enabled research platforms. Pharmas such as Servier, Eli Lilly, Merck KGaA, AbbVie and Gilead Sciences rank among the leaders in leveraging digital health ventures to transform discovery and clinical development, while companies including Otsuka Pharmaceutical, Daiichi Sankyo and Eisai stand out for their focus on continuous patient engagement and adherence.

A data-driven benchmark for the next decade

Unlike perception-based surveys, the Pharma Digital Health Innovation Index is built entirely on observable behaviour: real partnerships, repeat collaborations, evidence maturity and measurable signals of venture traction. Powered by HealthTech Alpha, it aggregates over one billion structured data points across regions, therapeutic areas and digital health categories to deliver an objective benchmark for the industry.

For pharma leaders, the Index serves as both a mirror and a roadmap, revealing whether current digital health efforts are truly aligned with strategic priorities and where gaps remain across the value chain. For investors, it offers rare visibility into which ventures are repeatedly selected by the world’s most demanding customers. And for digital health innovators, it sets a clear bar: strategic fit and clinical strength are no longer optional.

The 2025 release also coincides with Galen Growth’s 10th anniversary, marking a decade of tracking digital health’s evolution from fringe experiment to core strategic engine for life sciences and healthcare.

The Pharma Digital Health Innovation Index 2025 is now available for download from Galen Growth. The full report includes complete rankings, company profiles, partnership maps and deep-dive analyses of the trends that will define pharma’s digital trajectory into 2026 and beyond.

Julien de Salaberry

Galen Growth Inc

julien.desalaberry@galengrowth.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.